SAP Treasury & Risk Management (SAP TRM) – Live Online

About Course

The Most Powerful, Job-Focused SAP TRM Training Designed for High-Growth Careers in Corporate Finance, Treasury, Banking & Risk Management

Managing cash, liquidity, investments, foreign exchange, derivatives, and financial risk is the backbone of every global organization. As businesses grow internationally, the need for real-time treasury operations, accurate risk forecasting, hedge management, and compliance automation has become more critical than ever. This is exactly where SAP Treasury & Risk Management (TRM) stands out.

Our SAP TRM Professional Program is a comprehensive, hands-on, industry-driven training that helps you master the full capabilities of Treasury Management in SAP S/4 HANA. Whether you want to work in a corporate treasury team, financial risk department, banking environment, or as an SAP functional consultant — this course is designed to make you job-ready, confident, and technically strong.

This training goes far beyond traditional book-based learning. You will work on real SAP screens, capture live treasury transactions, configure money market, foreign exchange, securities & derivatives, perform end-to-end hedge accounting, manage credit & market risks, analyze exposures, generate treasury reports, and build a complete corporate treasury lifecycle project from scratch.

Throughout the program, you will learn how global companies manage their financial operations using SAP — including currency exposures, cash positions, liquidity planning, portfolio management, investment decisions, loan processing, regulatory compliance, and IFRS/IAS-based hedge accounting.

This means you will not only understand how SAP works, but also how the real world of corporate finance and banking works behind the scenes.

Every concept is taught with live examples, real business scenarios, financial logic, accounting background, and SAP best practices — ensuring you gain the depth of knowledge that top companies expect from an SAP TRM Consultant.

The course includes:

Live Instructor-Led Training

Lifetime Access to Class Recordings

3 Months of SAP S/4HANA Server Access

Real-Time Business Scenarios

End-to-End Treasury Implementation Project

Hands-on Exercises & Daily Assignments

Interview Preparation & Resume Support

By the end of this course, you will be fully equipped to handle corporate treasury processes, evaluate financial risks, perform valuation and accounting, generate regulatory reports, configure SAP systems, and confidently work as a Treasury Analyst, SAP TRM Consultant, Risk Analyst, Cash & Liquidity Manager, or Financial Market Specialist.

This is one of the most premium, in-demand and high-paying SAP modules, especially in sectors like Banking, FMCG, Pharmaceuticals, Energy, Manufacturing, Telecom, and Fortune 500 companies.

If you’re looking to build a future-proof career in finance + technology, SAP TRM is one of the best choices — and this course gives you everything you need to excel.

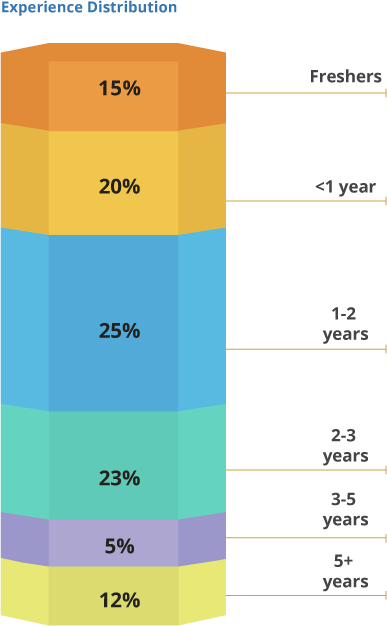

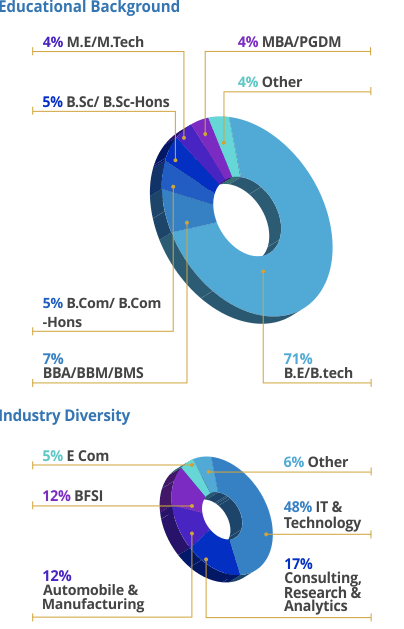

SAP TRM Batch Profile

Our students include freshers and experienced professionals from across industries, functions and backgrounds.

Sample Certificate

FAQ’s

1. What exactly is SAP Treasury & Risk Management (TRM), and why is it so important?

SAP TRM is the world’s leading platform used by top global companies to manage cash, investments, loans, foreign exchange, financial risks, hedging, and liquidity.

Every major enterprise — including Fortune 500 companies — uses SAP TRM to ensure financial stability, accurate forecasting, and compliance with international standards.

This course makes you proficient in one of the most premium and high-paying SAP modules, opening doors to corporate finance, banking, and global consulting careers.

2. Is this course suitable for beginners or do I need finance/SAP experience?

No prior SAP experience is required.

We teach everything from basic treasury concepts to advanced S/4HANA configurations in a simple, step-by-step manner.

Even if you’re from a non-finance background, the course includes enough fundamentals for you to grasp the entire treasury lifecycle.

3. Will I get practical, real-time hands-on practice?

Absolutely — this is a highly practical course.

You will be working on live SAP S/4HANA sessions with:

✔ Money market deals

✔ FX transactions

✔ Securities and derivatives

✔ Debt and investment management

✔ Hedge management

✔ Market risk & credit risk analyzer

✔ Treasury reporting & Fiori apps

✔ End-to-end corporate treasury project

Everything is done practically inside SAP — not theoretical explanations.

4. Will I get lifetime access to class recordings?

Yes!

All live sessions are recorded and you receive lifetime access.

You can revise anytime, rewatch difficult topics, or catch up if you miss a class.

5. Will I get SAP server access for practice?

Yes.

You receive 3 months of SAP S/4HANA server access for hands-on practice.

This ensures you become confident with every module and scenario taught in class.

6. What job opportunities can I expect after completing this course?

After completing this program, you can apply for roles such as:

SAP TRM Consultant

SAP FSCM Consultant

Treasury Analyst

Risk Analyst (Market / Credit / Liquidity)

Financial Instruments Specialist

Banking & Capital Market Consultant

Cash & Liquidity Manager

SAP TRM professionals earn some of the highest salaries globally due to the complexity and importance of treasury operations.

7. Do companies actually use SAP TRM?

Yes — some of the world’s biggest organizations rely on SAP TRM including:

Banks

Multinational corporations

FMCG, Pharma, IT, Telecom, Retail

Energy & Infrastructure companies

Investment firms

Capital market institutions

Treasury operations exist everywhere, so demand is consistently high.

8. What type of projects will I work on?

You will work on a full end-to-end corporate treasury project, including:

✔ FX deals (spot, forward, swap)

✔ Money market negotiations & settlements

✔ Securities & derivatives lifecycle

✔ Hedge effectiveness testing

✔ Market & credit risk analysis

✔ Valuation, accruals, postings

✔ Treasury reporting & dashboard building

This gives you strong hands-on experience for job interviews.

9. What if I miss a live class?

No issues at all.

You get:

✔ Lifetime class recordings

✔ Notes

✔ Assignments

✔ Doubt support

So you will never miss anything.

10. Can I shift from non-technical or non-finance background to SAP TRM?

Yes, absolutely.

Many learners with BCom, BBA, BA, BSc, MCA, MBA backgrounds succeed in SAP TRM roles because the course explains every concept from scratch.

Course Content

MODULE 1 – Introduction to SAP Treasury & Risk Management

What is Treasury Management?

Overview of Financial Risk Management

SAP TRM in the S/4HANA Finance landscape

Key components of SAP TRM

Integration with FI, CO, FSCM & Bank Communication Management

End-to-end Treasury process flow in enterprises

Corporate treasury structure & roles